- Latest survey of 3,600 Singapore-based SMEs by SBF and DP Info shows general sentiments turning neutral at 50.4, with softer Turnover and Profitability Expectations

- SMEs’ Capital Investment Expectations increased this quarter with the Manufacturing sector and Retail/F&B sector seeing the largest upticks, a sign of growing focus on business transformation with a view on investing for the long-term

- The business sentiment of SMEs in the Manufacturing sector dipped below 50 to 49.7, showing the sector in contraction for the first time in the past eight quarters

SINGAPORE, 25 March 2019 – Singapore SMEs are looking to invest in business transformation despite expectations of a soft economic environment outlook in the next six months, together with lower turnover and profitability.

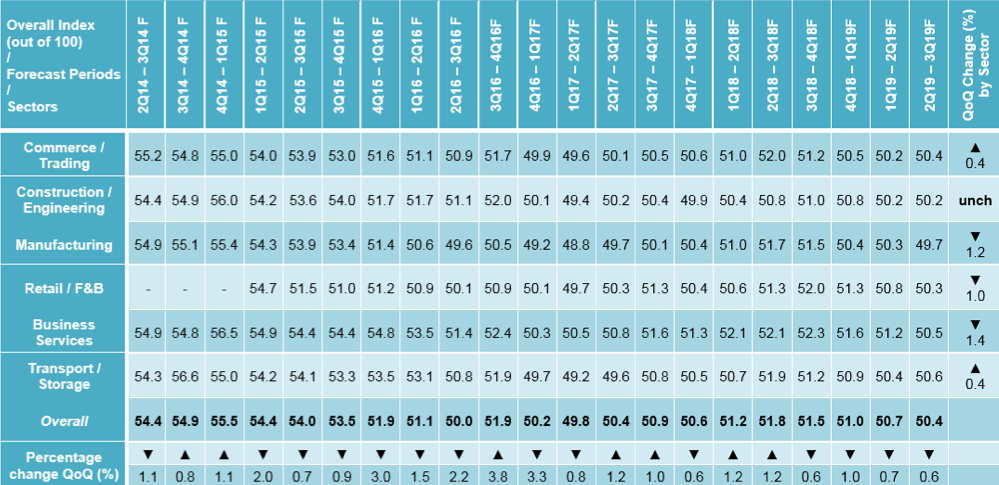

The SBF-DP SME Index (the Index) has seen a dip from 50.7 to 50.4 this quarter, indicating an easing of business sentiment and increased caution among SMEs. This is the fourth consecutive quarter with a lowering in the reading: 51.8 (2Q2018), 51.5 (3Q2018), 51.0 (4Q2018), and 50.7 (1Q2019).

The Index – a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info), part of Experian – measures the business sentiment of SMEs for the next six months (April 2019 to September 2019). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation, and Access to Financing. This index is based on a survey of more than 3,600 SMEs conducted between 14 January and 1 March 2019.

Figure 1: Outlook for 2Q2019 – 3Q2019F (April 2019 to September 2019)

Along with a neutral sentiment reading, the latest Index reading highlights lower Turnover Expectations (from 5.13 to 5.03) and Profitability Expectations (from 5.07 to 4.94) as the two biggest strains among the seven expectations measures.

This marks the first time in six quarters that Profitability Expectations has dropped below a reading of 5.0, indicating an increase in uncertainty for the SMEs.

UPTICK IN CAPITAL INVESTMENT EXPECTATIONS

Despite an overall lowered and neutral outlook, the Index shows an increase in Capital Investment Expectations across all sectors, except Business Services. These were cautiously positive this quarter at 5.18, edging up from 5.16 last quarter. Due to the survey period, this could be reflective of initial reactions to SME-related funding initiatives announced during the Singapore Budget 2019 on 18 February this year. This could also indicate a growing focus on business transformation with a view on investing for the long-term success.

In particular, the Manufacturing sector saw the highest uptick in Capital Investment Expectations (up 2.15% to 5.23). This suggests that manufacturing companies are taking necessary steps to transform their business such as investing in digitalising its processes as they expect the near-term moderation in turnover and profit to thin.

Mirroring the trend from the Manufacturing sector, the Capital Investment Expectations for the Retail/F&B sector continue to increase this quarter (up 1.71% to 5.35). This is potentially due to SMEs in the sector continuing to embrace technology innovation and digital solutions such as e-payment methods and delivery platforms to improve customer experience and service.

MANUFACTURING SECTOR SHOWS CONTRACTION WITH DIP BELOW 50

The Manufacturing sector saw a 1.20% quarter-on-quarter weakening in sentiment from 50.3 to 49.7 in January 2019. A 3.87% year-on-year easing, this is the first time the sentiment dipped below 50 in the past eight quarters.

This reading was derived from a decline in five out of seven expectations – Turnover (down 5.53% to 4.78), Profitability (down 5.41% to 4.72), Business Expansion (down 1.13% to 5.27), Capacity Utilisation (down 3.52% to 6.58), and Access to Financing (down 1.00% to 4.95).

For this sector, the weakening in Turnover Expectations and Profitability Expectations saw the biggest decrease in sentiment over this quarter. This is possibly due to declining factory output which indicates a weakness in manufacturing demand.

The significant moderation in the Manufacturing sector reflected in the Index also corresponds to the recent findings of an MAS Survey where economists have expected the Manufacturing sector to register a conservative 2.0% growth in 2019 as compared to 7.2% in 2018.

Mr James Gothard, General Manager, Credit Services & Strategy SEA of Experian, the parent company of DP Info, said, “It is heartening to see that despite the current headwinds, we are seeing a real sense of momentum and resilience amongst SMEs as Capital Investment Expectations saw an overall increase this quarter. However, we do see the Manufacturing sector reading weaken below 50 for the first time in two years continuing a downward trend from the past four quarters. Though we do believe that this is temporary, in the longer horizon, we may see them bearing fruits due to their investments in business transformation.”

Mr Ho Meng Kit, CEO, SBF said, “The unresolved geo-economic and geopolitical conflicts continue to weigh on the confidence of SMEs, but we urge our companies to keep their eyes focused on the longer term and persist with their business transformation efforts to sharpen quality and improve productivity. This will help them stay ahead of increasing global competition and keep pace with industry changes.

We are encouraged by the uptick in Capital Investment Expectations as a sign of recognition among our SMEs that it is becoming critical to adopt automation and other tech-powered solutions to stand the best chance of success in the future. They should leverage on the various government measures to support SMEs particularly in adapting to Industry 4.0, whether it’s upskilling their workforce or investing in technology solutions.

Amid softening global demand and uncertainties related to the US-China trade dispute, which has resulted in a more challenging environment for exports and the manufacturing sector, we remain confident that there are opportunities for companies to venture overseas for growth. SBF continues to actively engage our companies to make effective use of Singapore’s extensive network of Free Trade Agreements (FTAs) and will keep up our momentum of business transformation activities such as training and providing members with overseas business opportunities through business missions and global trade fairs such as the China International Export Expo 2019.”