- Varying impact, with commerce-wholesale and transport/storage sectors most affected

- Trade payment trends across all SME sectors are generally stable

SINGAPORE, 08 November 2018 – The impact of trade tensions may be starting to affect Singapore SMEs that are most exposed to global trade, a study of the payment data of more than 120,000 companies in Singapore across a broad range of sectors has indicated.

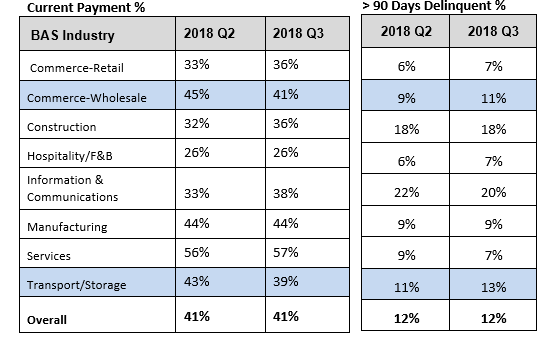

The payment patterns of SMEs across eight major sectors were analysed in terms of timeliness – payment within terms, within 90 days and above 90 days. The proportion of SMEs in the commerce-wholesale sector that made their payments within terms declined from 45% to 41% quarter on quarter (QoQ), for the period ending September 2018. For the transport/storage sector, it decreased from 43% to 39% for the same period.

These two sectors also registered a marginal increase in the proportion of SMEs that are more than 90 days delinquent. The proportion of SMEs in the commerce-wholesale sector which were more than 90 days delinquent went up from 9% to 11% QoQ. For the transport/storage sector, it increased from 11% to 13%. However, in general, delinquency rates across the SME sector were stable.

Mr James Gothard, General Manager, Credit Services & Strategy SEA of Experian, said: “Over the past year, there has been an increase in US-China trade tensions, associated with tariffs, which may be beginning to show its effect. Commerce-wholesale and transport/storage are the sectors that can be impacted by global trade tensions.”

Mr Gothard added: “Trade tariffs, through their downstream effects, have the potential to impact Singapore’s SMEs in a number of ways – by reducing the competitiveness of their exports and by affecting sales in overseas markets. Even if a specific country is not the target of tariffs, demand for intermediate goods from a country that is the target can be impacted.”

In the last quarter ending September 2018, business sentiment among SMEs for the six months to end-March 2019 have also dampened, with lower revenue and profitability expectations across all sectors, as indicated by the SBF-DP SME index. In the backdrop of the US-China trade tensions, SMEs in general have become more cautious, but this has been tempered by regional opportunities in Southeast Asia as well as by the year-end festive season which is likely to be marked by an uptick in spending.

Mr Gothard said: “A considerable number of Singapore SMEs still derive their revenue sources from external markets. Coupled with increasing domestic competition, there may well be a reprioritisation of market opportunities, with greater focus on emerging marks such as the Philippines, India and Myanmar.”