July 26, 2017 [Singapore]: The percentage of SME debt paid on time fell to just 37 per cent in the second quarter of 2017 – the lowest level in two years.

This change in SME payment behaviour was revealed in new research released today by DP Information Group (DP Info), part of the Experian group of companies. The research

analyses the payment patterns of more than 120,000 companies in Singapore during the second quarter of 2017.

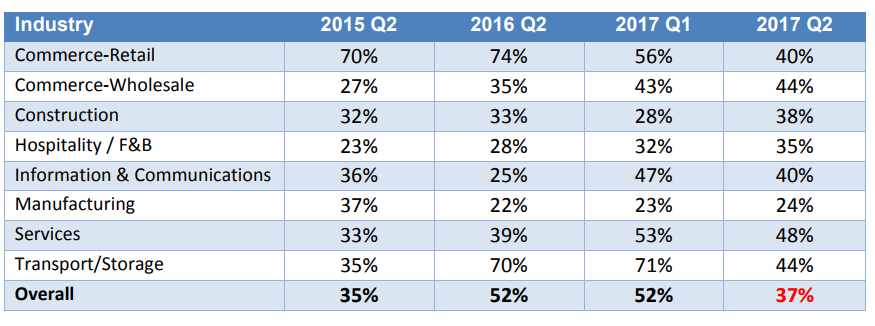

The research found the proportion of SME debt paid on time fell from 52 per cent in Q1 2017 to 37 per cent in Q2 2017 – a drop of 15 percentage points. This is the lowest level since Q2 of 2015, when the percentage of on-time payments was 35 per cent.

Table 1: Percentage of debts paid on or before due

While the proportion of unpaid debts rose during the quarter, the percentage of severely delinquent debts – those still unpaid 90 days after they fall due – did not change. The percentage of debts unpaid after 90 days remained at 14 per cent in Q2, the same level as in Q1.

Mr Sonny Tan, General Manager of DP Info said the most likely explanation for the change in payment behaviour is that SMEs are managing their cash flow by prioritising which debts to pay first.

“We are seeing an unusual pattern of fewer on-time payments, without an increase in overall defaults. This means SMEs are taking longer to pay a debt, rather than experiencing an inability to make payment.”

“This behaviour indicates SMEs need the money for other things, such as funding growth opportunities in anticipation of greater demand in the second half of the year.”

“According to the most recent SBF-DP SME Index, SMEs expect an improvement in their sales in the second half of 2017. They are also keen to pursue business expansion by increasing their market share, targeting new markets or introducing new products and services. SMEs may be choosing to use their resources to fund business expansion instead of making prompt payments on their bills.”

“The problem is they are funding their growth and inventory expansion with other companies’ money. If this pattern continues for several quarters it may have an impact on the overall cash flow position of the SME community. There is a ripple effect when a debtor company delays payment as the creditor company may also slow down its payment to companies it owes money to.”

“SMEs worried about getting paid should take steps to secure greater insight into sectorial payment patterns. Joining the DP SME Commercial Credit Bureau and contributing their payment data provides the SME ecosystem with shared intelligence accessible to all member SMEs. This acts as an early warning system for SMEs as they will be alerted when a company that owes them money fails to pay another company on time,” Mr Tan said.

DAYS TURNED CASH

While the percentage of unpaid debts is on the rise, so too is the time it takes SMEs to make good on a debt.

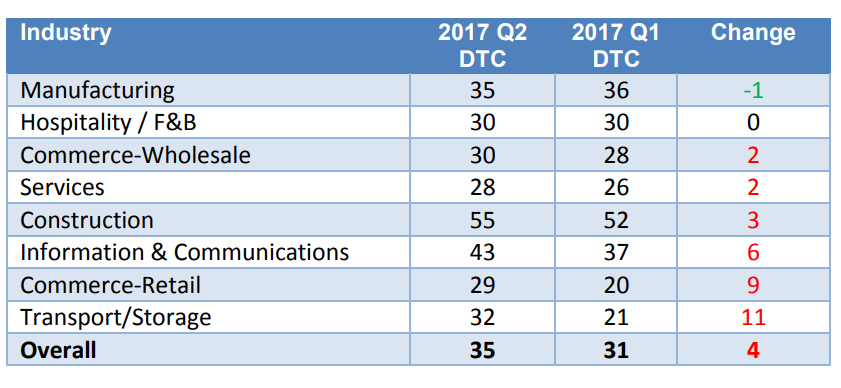

The Days Turned Cash (DTC) National Average – a measure of the payment behaviour of SMEs – increased from 31 days in Q1 to 35 days in Q2 2017.

Table 2: Days Turned Cash National Average

The lengthening of payment times occurred in all industries except the manufacturing sector which decreased its average payment time by one day.

The Transport/Storage sector had the largest increase in payment times, taking an average of 11 additional days to pay a debt in Q2 compared to Q1 2017. The DTC for this sector has averaged in the low 20s for several consecutive quarters, suggesting companies may need more working capital this quarter to fund additional orders. As a result, they are diverting resources away from debt settlement towards other opportunities.