- SBF-DP SME Index falls below 50 for the first time in seven years

- Turnover and profitability expectations at record lows, with the Business Services sector moderately optimistic in maintaining their sales

Singapore, Wednesday, 21 December 2016 – Small and medium enterprises are pessimistic about their prospects for the first half of 2017 and expect a reduction in both their turnover and profitability.

The latest SBF-DP SME Index, which measures the business sentiment of SMEs in coming two quarters, shows SMEs expect their businesses to be worse off in the first six months of 2017 than they are now.

The Index measures the business sentiment of SMEs for the next six months (Q1 and Q2 of 2017) and is a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info). DP Info is part of the Experian Group. More than 3,600 SMEs were surveyed between October and November 2016 on their outlook and sentiment.

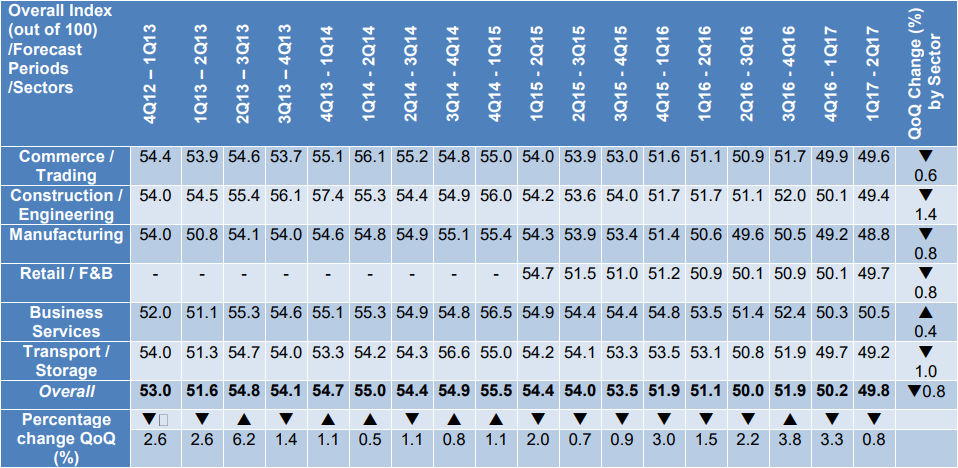

The Overall Index score fell by 0.80 per cent to a score of 49.8. This is the first time in the seven-year history of the Index that it has fallen below 50.0, indicating a pessimistic outlook.

Five of six industries now have a negative outlook for the coming half year, with the Business Services Sector recording a neutral Index score of just 50.5.

TURNOVER

The Index scores for Turnover and Profitability Expectations are both at record lows. SMEs engaged in Commerce/Trading, Construction/Engineering, Retail/F&B, Manufacturing and Transport Storage expect their turnover to decline in the next six months. The Business Services sector is slightly optimistic that their sales will be

maintained.

PROFITS

For the second consecutive quarter, SMEs expect their profits to fall. The Profitability Expectations Index score fell from 4.76 to 4.71, indicating how reduced sales and high operational costs are compressing already lean profit margins and driving many SMEs into losses.

Construction/Engineering, Manufacturing, Retail/F&B and Transport/Storage SMEs are all expecting lower profits in the first half of 2017. Construction/Engineering SMEs indicated the steepest decline in profit expectations – a fall of 4.82 per cent.

A relatively flat reading of 5.01 suggests that Business Services SMEs are not expecting any change in performance compared to the previous quarter.

Table 1: Outlook for 1Q17 – 2Q17F (January 2017 to June 2017)

Comments from SBF

Mr Ho Meng Kit, CEO of SBF, said “SMEs are facing challenging conditions in the current economic situation. This is in line with the slowing overall economy with Ministry of Trade and Industry narrowing Singapore’s GDP growth forecast for the year from 1.0 to 2.0 percent, to 1.0 to 1.5 percent. The SBF-DP SME Index showed similar trends, with the latest Overall Index score recording a contractionary reading of 49.8.

Against this pessimistic backdrop, it is worthwhile to note that three out of the seven Index scores, namely, Business Expansion Expectations, Capital Investment Expectations and Hiring Expectations signalled modest optimism. These signalled resilience of our SMEs to look for growth in the medium term.

SBF is cognisant that slowing growth and global volatility amid the ongoing economic restructuring, coupled with rising business costs, will continue to pose formidable headwinds for SMEs. In the upcoming SBF-led SME Committee’s recommendations for Budget 2017, the recommendations will be aimed at helping SMEs to navigate

the immediate challenges of high business costs. The recommendations will also focus on helping SMEs sustain growth particularly during this current economic climate, as well as support scalable, local-based enterprises to develop into globally competitive companies.”

Comments from DP Info

Mr Nick Boyle, Managing Director SEA & Emerging Markets of Experian, said global factors are weighing heavily on the minds of SMEs.

“The second half of 2016 has seen many developments which would make an SME leader worried about the future.”

“The UK Brexit referendum together with the delay in finalising the Singapore-EU Free Trade Agreement has resulted in a decline in Singapore’s exports to Europe.”

“We have also witnessed a US election where both presidential candidates campaigned against the Trans Pacific Partnership agreement.”

“At home SMEs had to digest the news that GDP fell by 4.1 per cent quarter-onquarter in the third quarter – a result which places Singapore at risk of a technical recession should GDP contract again.”

“Given the cumulative impact of all these developments, it is understandable that SMEs see little prospect of growth for the coming six months,” Mr Boyle said.