- SMEs in the Commerce / Trading sector has seen a measured lift in sentiment over the quarter, though still contractionary, as the demand for trade shows early signals of recovery

- The Business Services sector is the only sector that registered a lower Turnover Expectations reading

- SMEs are taking a cautious wait-and-see approach to 2021, expecting a gradual but uneven recovery

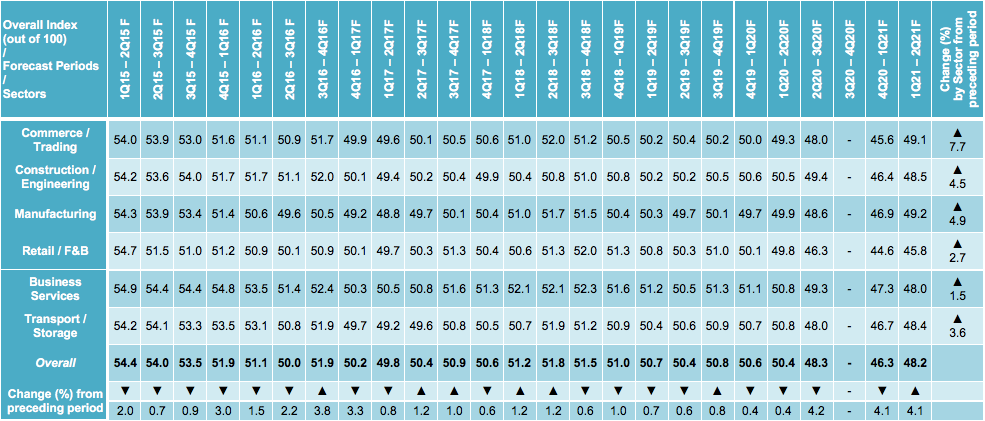

SINGAPORE, 22 December 2020 – The global economy is seeing signs of gradual recovery from the economic fallout due to the COVID-19 pandemic. The SBF-Experian SME Index for 1Q21 – 2Q21F registered an overall reading of 48.2, an uptick from 46.3 in the 4Q20 – 1Q21F SBF-Experian SME Index.

Even with the resurgence of the virus in some parts of the world, restrictions have begun to ease in some countries, and economic markets have seen gradual though uneven recoveries. The United States GDP increased at an annual rate of 33.1% in 3Q20 as fiscal stimulus programmes were implemented alongside continued efforts to reopen businesses and resume operations, while China’s economy showed signs of resilience and vast potential by advancing 4.9% year-on-year in 3Q20, an improvement over its 3.2% year-on-year increase in the previous quarter.

In Southeast Asia, some countries have returned to curfews and lockdowns as COVID-19 cases spiked. On the domestic front, Singapore’s economy contracted by 5.8% year-on-year in 3Q20 as both local and international demand weakened due to the pandemic. As a result, the Ministry of Trade and Industry (MTI) has narrowed Singapore’s 2020 GDP forecast to “-6.5% to -6.0%” while projecting a growth of “4.0% to 6.0%” in 2021, based on the expected easing of global travel restrictions, domestic public health measures, and the potential availability of a COVID-19 vaccine in the year ahead.

These developments are largely reflected in the Index which remains in the contractionary region (less than 50 in the registered reading), although there is a relatively measured overall lift in sentiments observed.

The Index – a joint initiative of the Singapore Business Federation (SBF) and Experian – measures the business sentiments of small and medium-sized enterprises (SMEs) in Singapore for the next six months (January 2021 to June 2021). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation, and Access to Financing. This Index is based on a survey of more than 2,100 SMEs across six sectors – ‘Commerce / Trading’, ‘Construction / Engineering’, ‘Manufacturing’, ‘Retail / F&B’, ‘Business Services’, and ‘Transport / Storage’. This survey was conducted between 6 October 2020 to 13 November 2020.

Outlook for 1Q21 – 2Q21F (January 2021 to June 2021)

[Survey Period: 6 October 2020 to 13 November 2020]

*Note: 3Q20-4Q20F data collection paused due to Circuit Breaker

The overall outlook of Singapore’s SMEs for 1Q21 – 2Q21F is now at a registered reading of 48.2, indicating a muted recovery in sentiments from the record low reading of 46.3 observed in the last quarter. While SMEs in the six sectors surveyed continue to register readings below 50, sentiments have gradually improved across the board.

Even as SMEs emerge from the economic fallout due to the COVID-19 pandemic and look forward to a gradual economic recovery, they remain cautious about the immediate future as they enter the new year. The Commerce / Trading sector has seen the biggest shift in sentiments over the quarter (up 7.7% to 49.1), as international trade volumes are expected to recover better than initially expected by 2021, with the easing of restrictions.

Overall, sentiments have seen a measured lift in five out of seven indicators. Upticks were observed in Turnover Expectations (from 3.67 to 4.54), Profitability Expectations (from 3.57 to 4.46), Hiring Expectations (from 5.08 to 5.11), Capacity Utilisation Expectations (from 5.77 to 6.46) and Access to Financing Expectations (from 4.87 to 4.92).

Decreases in Business Expansion Expectations (from 5.08 to 5.04) and Capital Investment Expectations (from 5.03 to 5.00) is a possible reflection that SMEs are still cautious in the areas of growth and investment in the early part of 2021.

Early Signs of Gradual Business Recovery Observed

To augment existing support measures announced earlier by the Singapore government, the Monetary Authority of Singapore (MAS) and the financial industry have committed to extend their support to SMEs, who are facing cash flow difficulties, and help them transition gradually to full loan repayments.

With these measures in place, SME businesses owners are looking at a somewhat better business climate in terms of turnover and profitability, although they are not expecting a full recovery to pre-pandemic levels.

Overall, Turnover Expectations is witnessing a 23.71% improvement to 4.54 (from 3.67). Five out of the six sectors tracked see sentiments rise by double-digit rates, with sentiments in Commerce / Trading registering the sharpest increase from the previous quarter (up 45.28% to 4.62). The Business Services sector is the only sector that registered a worsening Turnover Expectations reading (down 1.25% to 3.96).

SMEs across the six sectors also saw an easing of negative sentiments in the Profitability Expectations (up 24.93% to 4.46). Similar to the Turnover Expectations indicator, the Business Services segment lagged other sectors in the easing of negative sentiments for Profitability Expectations, although it has seen a marginal increase (up 3.22% to 3.85 from 3.73).

Amid These Signs, SMEs Still Taking a Cautious Approach to 2021

With SMEs anticipating a gradual, albeit uneven recovery of the economy, a more cautious approach may be adopted, with Business Expansion Expectations and Capital Investment Expectations remaining considerably neutral.

Business Expansion Expectations decreased slightly over the quarter (down 0.79% to 5.04), with current challenges on day-to-day operations deterring SMEs from seeking expansion opportunities, marking a new low for the indicator. Over the quarter, the Retail / F&B segment has tempered its sentiment (down 2.88% to 5.06). SMEs in the sector may be expecting a slower-than-usual surge in consumer spending during the 1Q21 holiday season and foresee difficulties in attracting local demand and spurring spending in 2Q21.

Five of the six sectors being tracked have seen sentiments fall in Business Expansion Expectations with the Commerce / Trading sector being the exception, with an improvement of 5.15% to 5.10. The outlook for this external facing sector appears to have been lifted by reduced business uncertainties, an improving global trade environment and recovering supply chains.

At a reading of 5, SMEs are expecting to hold back from any increase in Capital Investment spending over the next six months, as companies seek to better manage cash flow and stretch current funds for business sustainability in the immediate term.

Higher Levels of Hiring Observed Among SMEs

Over the next six months, SMEs are expecting marginally more hiring activities (up 0.59% to 5.11). They remain cautious and are only looking to meet critical business needs at a time when turnover and profits are not expected to return to pre-pandemic levels.

Compared to other sectors, the uptick was led by the Commerce / Trading segment (up 4.37% to 5.25), which may be a result of the segment needing more manpower to address its operational gaps resulting from a relatively faster demand recovery.

Indications of an Improving Business Outlook in the Next Six Months

With guarded expectations in business demand and economic recovery, SMEs are expecting Capacity Utilisation to improve with a reading of 6.46 – with all five sectors tracked for this indicator, recording an uptick. This represents an increase of 11.96% from 5.77 from the previous quarter. Manufacturing SMEs saw the biggest improvement in Capacity Utilisation Expectations (up 18.74% to 6.78).

“The gradual economic recovery from the ongoing COVID-19 pandemic has helped to ease negative expectations of SMEs, although it looks uneven across the board. The Commerce / Trading segment saw sharp improvements observed in Turnover and Profitability Expectations, while Business Services is lagging behind. Despite having to be prepared for a resurgence of COVID-19 cases, a protracted and patchy recovery period, global geopolitical uncertainties, and different tracts of challenges for the different sectors, SMEs are expecting a gradual revival, which has shaped their cautious approach to the first half of 2021,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

There has been robust government support provided to facilitate hiring activities and ease credit access for SMEs. Government measures that inject cheaper loan capital to help companies tap onto available funds have eased the constraints of SMEs on their Ability to Access Funding. As the external trade environment has improved, the Commerce / Trading sector is expecting easier financing access (up 9.83% to 5.25).

This expected recovery may lead to additional lenders assisting SMEs with more funding support. Along with these local support measures, and recent macroeconomic factors such as the signing of the Regional Comprehensive Economic Partnership (RCEP) and the positive news on vaccine development, there continues to be measured upsides for SMEs to emerge stronger and tap new opportunities to seek active growth in 2021.

Mr Ho Meng Kit, CEO of SBF, said that “The uncertain business climate continues to weigh on the confidence of SMEs, as they remain cautious about their immediate future. The recent announcements on Singapore’s Phase 3 reopening of our economic activities and the availability of the COVID-19 vaccine, are positive news for our business community. They bode well for the recovery and growth of our businesses. We hope that businesses will continue to guard against the virus for the safety of their operations, customers and employees. We urge SMEs to pay particular attention to their financial management as revenue sources are still challenged whilst Government support are expected to be gradually wound down next year. They should continue with their business transformation efforts, always looking for opportunities to thrive and build resilience in a fast-changing environment.”