Service companies now the fastest debt payers in Singapore

SINGAPORE, 03 May 2018: Singapore SMEs are paying their debts faster as their as financial fortunes continue to improve.

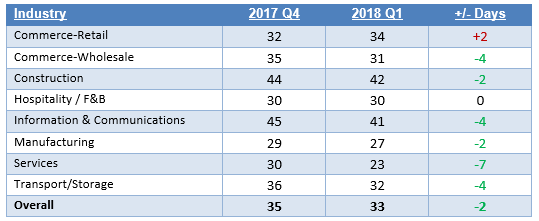

The Days Turned Cash National Average (DTC) – a measure of how quickly SMEs pay their debts – improved to 33 days in Q1 2018, compared to 35 days in Q4 2017 and 36 days in Q3 2017.

The DTC is compiled and published by DP Information Group (DP Info), part of the Experian group of companies, and is based on the payment data of more than 120,000 companies.

Six of eight sectors are paying their debts faster now than three months ago, with the hospitality/F&B sector recording no change. Only the retail sector had slower payments, taking two days longer than last quarter.

Figure 1: Days Turned Cash National Average (Q1 2018)

The services sector recorded the largest improvement in payment behaviour with the time taken to settle a debt falling by seven days. Services companies are now the fastest payers in Singapore, taking 23 days on average to pay a bill.

The construction sector were the slowest payers, taking an average of 42 days to pay a bill in Q1 2018. The lengthy payment period is not necessarily an indication of financial weakness as the construction industry tends to have longer payment terms than other sectors. Compared to Q4 2017, construction companies are now taking two fewer days pay their debts.

Mr James Gothard, General Manager, Credit Services & Strategy SEA of Experian said the improvement in debt payment behaviour is a sign the fortunes of SMEs are improving.

“There are fewer SMEs struggling to pay their debts compared to three months ago, which is a sign of improved trading conditions.”

“We are seeing faster debt payments across most industry sectors in Singapore which means the recovery among SMEs is not limited to just one or two sectors.”

“Compared to last quarter, retail companies are the only group which is taking longer to settle their debts. The retail sector continues to struggle with rents, labour costs and the challenge of online competition, all of which can make it harder to have the cash available when a debt falls due.”

“Most retail companies are on very tight credit terms with their suppliers and there has been no change in the amount of debt unpaid 90 days after it falls due. Retail companies are still paying their debts, but they are taking a little longer to do so,” Mr Gothard said.