Singapore, Thursday, 17 March, 2016 – After six straight years of optimism, the sentiment of Singapore SMEs is now neutral, according to the latest SBF-DP SME Index (the Index).

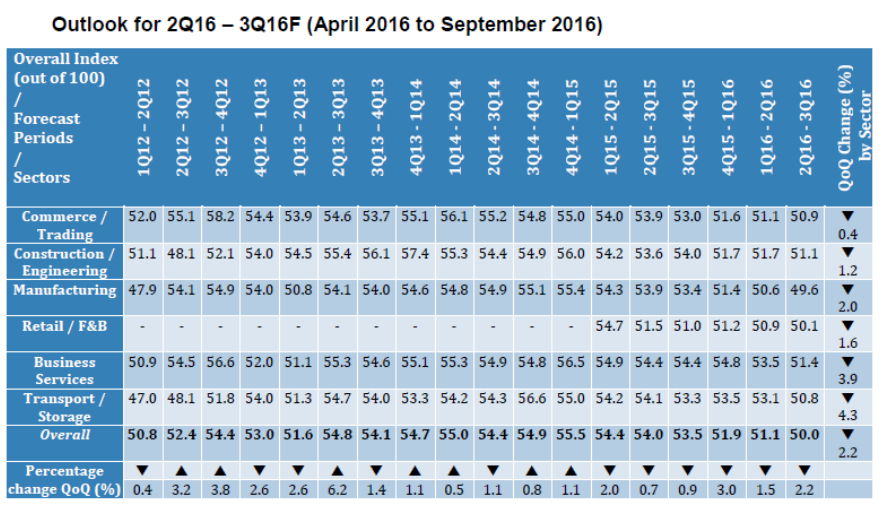

The Overall Index score fell 1.1 points to 50.0 – a score which indicates SMEs do not expect to achieve any growth during the next six months.

The Index measures the business sentiment of SMEs for the next six months (Q2 and Q3 of 2016) and is a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info). Some 3,600 SMEs were surveyed over January and February 2016 on their outlook and sentiment.

The score of 50.0 is the lowest score since the Index was first published in the first quarter of 2010.

The fall in sentiment was across all six industry sectors with the Transport/Storage sector recording the largest fall in its Index score of 2.3 points, from 53.1 to 50.8. The second largest fall was recorded by the Business Services sector which fell from 53.5 to 51.4, a drop of 2.1 points.

Transport/Storage and Business Services were the two most optimistic sectors in last quarter’s Index and their steep decline in optimism has brought the Overall Index score into the neutral zone for the first time since 2010.

The Manufacturing sector recorded an Index score of 49.6. Any score below 50.0 means the sector believes it will see a contraction during the next six months.

Comments from SBF

Mr Ho Meng Kit, CEO of SBF, said “The convergence of domestic factors such as low economic growth and rising business costs, as well as global headwinds such as heightened volatility in the financial markets and a slowdown in the Chinese markets have impacted SMEs in Singapore.”

He added “Both the Turnover Expectations and Profitability Expectations indices from the SBF DP Information SME Index for Q2-Q3 2016 registered weaker quarteron-quarter readings, reflecting the current state of the business health in Singapore.”

At the same time, Mr Ho noted that SMEs are showing resilience amidst the challenging environment. “The indicators on Business Expansion expectations and Capital Investment expectations show marginal improvements and indicate that SMEs are positive in the medium to long term. Meanwhile, SMEs should consider focusing on improving productivity and sourcing for new opportunities.”

Highlighting the recommendations surfaced in SBF’s Position Paper for a Vibrant Singapore, Mr Ho said “In the short term, the Singapore government could look at ways to help SMEs tide over the current challenging conditions, for example, by reviewing high business cost and holding back any increase in the foreign workers levy. In the medium to long-term, the government could adopt a more pro-business approach in policy formulation and development of enterprises. Further measures to encourage worker skills upgrading, innovation and internationalisation by companies will be greatly welcomed.”

Comments from DP Info

Mr Lincoln Teo, Chief Operating Officer of DP Information Group, said global and domestic issues continue to play on the minds of SMEs.

“Signs of strain have been surfacing – the latest of which being the consecutive yearlong fall in manufacturing output. While finding ways to cope with domestic pressures, Singapore’s SMEs are also acutely attuned to the state of the global economy. As Singapore is one of the world’s most open economies, the slowdown in global growth can be felt across all industries.”

“If you consider recent international economic news, it is easy to see why SMEs are finding it hard to remain optimistic.”

“China is adjusting to its new lower rate of growth, and US growth is being revised down.”

“The pressured domestic economy of China and reduction in imports by Chinese companies have seen its biggest hit on Singapore’s export numbers to China in seven years. Then there was the US Federal Reserve’s announcement on the end of quantitative easing which resulted in a hike in interest rates.”

“The US and China are two economies that heavily influence the outlook of Singapore companies, and the news from both are negative.”

“It is also worthwhile to note that amidst cautious times, SMEs are adopting a waitand-see approach, given the 2016 Budget announcement slated for March 24th. SME owners are thus inclined to pull back on their business outlook as they anticipate the upcoming plans to be revealed,” Mr Teo said.