SME optimism improves slightly though the outlook for profits remains weak

Singapore, June 21, 2017 – SMEs expect a small lift in revenue during the second half of 2017 in anticipation of stepped up activities relating to the year-end festive season. As a result, SMEs are slightly more optimistic about the next six months.

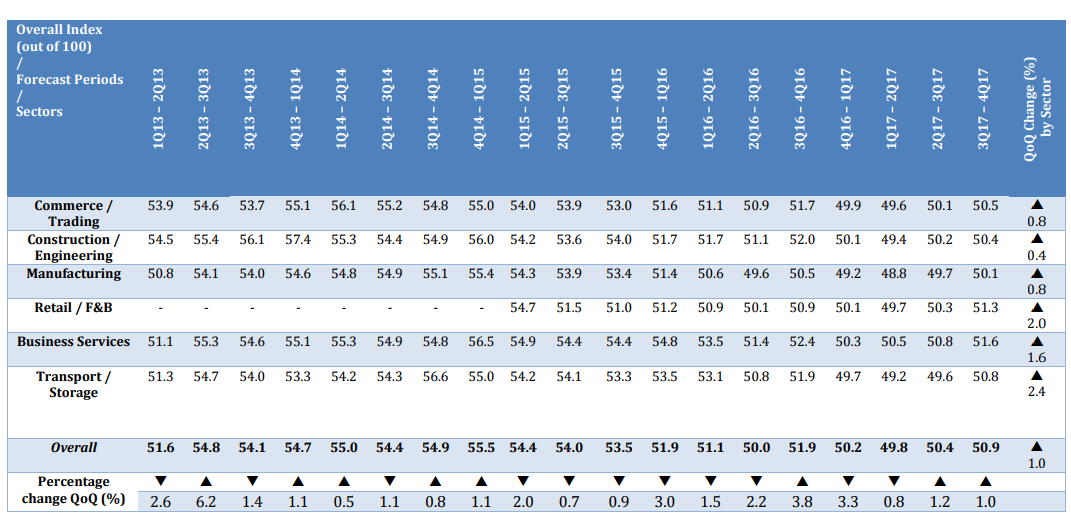

The latest SBF-DP SME Index (the Index) increased slightly, by 0.5 points, to 50.91 . While the improvement is modest, it is the second consecutive quarter in which SME optimism has improved across all six industry sectors, namely Commerce/Trading, Construction/Engineering, Manufacturing, Retail F&B, Business Services and Transport/Storage.

The Index measures the business sentiment of SMEs for the next six months (Q3 and Q4 of 2017) and is a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info). More than 3,600 SMEs were surveyed in April and May on their outlook.

Table 1: Outlook for 3Q17 – 4Q17F (July 2017 to December 2017)

The optimism is strongest in the Business Services sector with an Overall Index Score of 51.6, up from 50.8 last quarter. The Retail/Food and Beverage sector is the second most optimistic industry with an increase in its Index Score of 1.0 point to 51.3, indicating its improved confidence of better consumer demand during the coming two quarters.

The Manufacturing sector is the least optimistic of the six industries. However, this quarter is the first time in a year it has recorded a positive score, edging up from 49.7 to 50.1.

TURNOVER OUTLOOK

The most positive trend in this quarter’s Index is the improvement in turnover and profit outlook. All the six industry sectors measured have recorded improvements in their outlook for turnover and profits for two consecutive quarters.

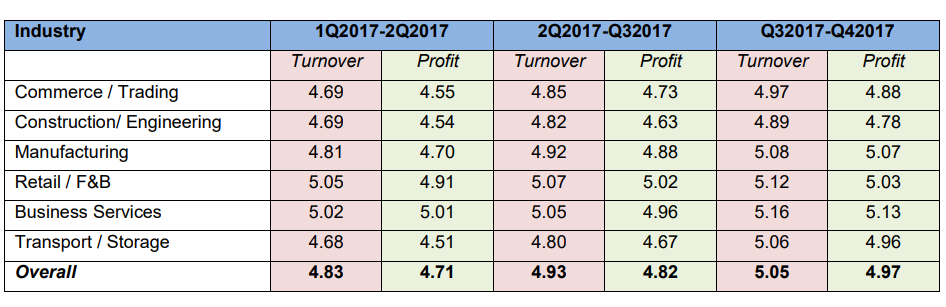

Table 2: Turnover and Profit Expectations

The Overall Turnover Expectations Index Score for this quarter is 5.05, up from 4.93 last quarter and 4.83 in the quarter before that. This means SMEs expect their sales to increase compared to the first half of the year.

PROFIT OUTLOOK

While sales are expected to increase, the outlook for profitability remains weak, with many SMEs expected to record limited profits over the next six months. While the Overall Profit Outlook Score of 4.97 is an improvement from that of the last quarter, it still indicates a weighed-down sentiment. This is the fourth consecutive quarter where the Overall Profit Outlook score is below 5.0, implying that SMEs are expecting a protracted period of reduced profits or even losses.

SMEs continue to struggle with costs such as salary and material prices. Operating costs in Singapore continue to be high with margins being eroded. Cost pressures, including the impending increase in utilities charges expected in the coming months, are dampening the SME community’s profit outlook. At the same time, SMEs need to spend money to grow their opportunities internationally.

BUSINESS EXPANSION PLANS

While profits are hard to come by, Singapore SMEs have not lost their appetite for business expansion. The Overall Index Score for Business Expansion Expectations for the current quarter is a healthy 5.60 as SMEs heed the government’s call to look for more innovative ways of doing business as well as growth opportunities outside of Singapore.

However, as Singapore SMEs continue to invest in Business Expansion, they have yet to realise immediate or near-term returns in the form of improved profits.

Retail / F&B and Business Services sectors have the greatest business expansion expectations for the second half of the year with their Index Scores of 5.77 and 5.71 respectively.

The Manufacturing sector experienced the greatest decrease in their Business Expansion Expectations, from a score of 5.65 last quarter to 5.48 this quarter. After sustained high levels of expansion in previous quarters, manufacturing SMEs are taking the time to evaluate their prior decisions.

COMMENTS FROM SBF

Ms Joanne Guo, Assistant Executive Director, Strategy and Development, of the Singapore Business Federation said, “It is heartening to note the increase in the latest Overall SME Sentiments Index although this is a slight increase, mainly due the move into the year-end festivities. The reading is the lowest second half reading in the last three years. This continues to reflect the uncertainty in the global economy and the tough local business environment.

SMEs continue to show resilience and optimism in the midst of this challenging environment from the improved overall readings of the Turnover, Profitability, Business Expansion, Hiring and Access to Financing expectations. SMEs should continue with their efforts to source for new opportunities, especially in overseas markets.

SBF also encourages SMEs to proactively leverage the Industry Transformation Maps to raise productivity, develop skills and drive innovation to better navigate through the challenges ahead.”

COMMENTS FROM DP INFO

Mr Sonny Tan, General Manager of DP Info said the improved outlook for sales in the second half of

the year is a positive trend, even if improvements were modest.

“The SME community expects a marginal boost to their sales due to increased domestic spending during the festive season. While the improvements will be modest, the good news is that the outlook has improved across every industry.”

“Improving sales are the key to the sustainability of our SMEs. Without increased sales, the profits of SMEs will be eaten away by increased costs.”

“SMEs have been investing in improving their productivity and efficiency. However, this can only keep internal costs in check. Externally costs such as rents, wages and finance remain a key concern for SMEs as they have less ability to control them.”

“Despite slow growth and global uncertainty, it is pleasing that SMEs have not lost their appetite for expansion, as they have consistently indicated their intention to increase their market share, target new markets and introduce new products,” Mr Tan said.