Outlook improves across all six industry sectors

SINGAPORE, 27 December 2017 – Prospects are looking up for Singapore SMEs with stronger sales and profits expected in the first half of next year.

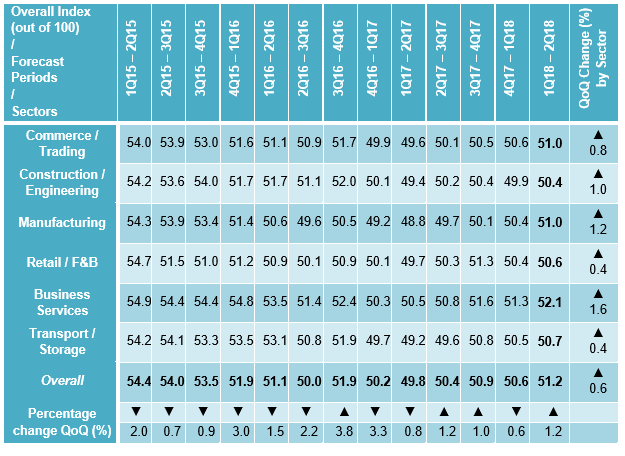

The latest SBF-DP SME Index (the Index) shows increasing optimism across all six industry sectors, lifting the Overall Index from 50.6 to 51.2.

The Index measures the business sentiment of SMEs for the next six months (January to June 2018) and is a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info), part of the Experian Group of companies. More than 3,600 SMEs were surveyed during October and November on their outlook.

SMEs are anticipating better business conditions in 2018 as improvements in the wider economy start to flow through to them. As a result, more SMEs expect to be operating at or near their capacity.

Table 1: Outlook for 1Q18 – 2Q18F (January to June)

Sentiment improved across all six industries, with each recording a score above 50.0, indicating an expectation of growth.

Business Services recorded the highest level of optimism, with an Overall Index Score of 52.1. Business services is a key supporting sector for other industries, providing a diverse range of functions such as real estate, engineering, management consultancy, legal and accounting functions. As the level of economic activity rises across other sectors, demand for business services also tends to increase.

After last quarter’s score indicated a mild contraction, the Construction and Engineering SMEs returned to optimism this quarter with a score of 50.4. The expectation of a stronger pipeline of public sector projects and the launch of the Industry Transformation Map for the construction sector have added to the sector’s positive outlook.

The Turnover Expectation Score rose from 5.01 to 5.15 as improvements were recorded by all six industries. Profitability Expectations also improved in each industry, lifting the score from 4.86 to 5.10.

While turnover and profits are main drivers of the improved outlook, there are other positive signs that better times are ahead for SMEs. Business Expansion Expectations continue to stay strong with a score of 5.55 as SMEs look for new opportunities to grow their business and generate more revenue.

SMEs also indicated greater confidence in their ability to access financing this quarter. Access to Financing Expectations increased from 5.01 to 5.13, with improvements observed across all industries.

The Capacity Utilisation Score rose from 6.81 to 7.11. A score above 7.0 indicates SMEs are operating at or near their full capacity. SMEs are increasing their output and gearing up their operations in anticipation of greater demand in the coming year.

Capital Investment is one component of the Index where the outlook of SMEs deteriorated across all six industry sectors causing the Index Score to fall from 5.28 to 5.14. Many SMEs may be holding back new capital expenditure as they await next year’s Government budget.

COMMENTS FROM SBF

Mr Ho Meng Kit, CEO of SBF, said “SMEs’ business sentiments have been deteriorating over the past three years, so this latest survey that SMEs across all sectors are feeling positive about their outlook for next year is welcome news. Our improved export performance and better performing service sectors have contributed to better sentiments of our smaller companies.”

“I urge our SMEs to ride on the tailwind of better times ahead to undertake serious effort to transform their companies. There is a long tail of SMEs which need to embrace digitalisation, improve their management so that they can be more innovative and competitive. Good times ahead have not eroded this urgent need for change. Government economic policies are supportive of our SMEs. With the formation of Enterprise Singapore in 2Q 2018, businesses can look forward to better coordinated efforts from the government to help elevate and strengthen businesses. SBF will continue to advocate for the business community, work with other Trade Associations and Chambers and Government to improve the state of our SMEs”, he added.

COMMENTS FROM DP INFO

Mr Dev Dhiman, Managing Director, South East Asia & Emerging Markets for Experian said the outlook of SMEs has been lifted by better economic news both at home and abroad.

“The mood of SMEs is improving, and they feel better times are coming next year. For SMEs there can be no better way to start the new year than with a boost in sales and profits.”

“The good news is that improvements are expected across all industry sectors, especially in the key indicator of profitability. The outlook for profits has declined for several years as SMEs adjusted to the restrictions on foreign manpower. Much of their potential for profits have been taken up by the need to invest in technology and innovation to become more productive with the manpower available to them.”

“SMEs have shifted their focus away from manpower issues allowing them to pursue strategies such as improving customer service, marketing and branding. These strategies are all about driving business growth by increasing market share and winning new customers.”

“While the outlook for 2018 is positive, it wouldn’t take much for the confidence of SMEs to be dented. A conflict on the Korean peninsula or the Middle East, or moves to wind back free trade and introduce protectionist measures all have the potential to push SMEs back into pessimism,” Mr Dhiman said.